IRS 4868 2024-2025 free printable template

Show details

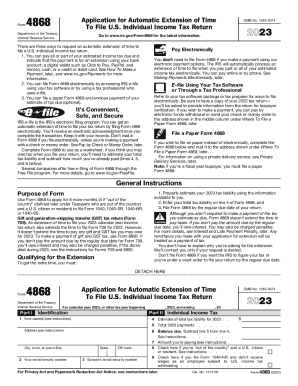

Don t staple or attach your payment to Form 4868. Note If you e-file Form 4868 and mail a check or money order to the IRS for payment use a completed paper Form 4868 as a voucher. Cat. No. 13141W Form 4868 2024 Page 2 When To File Form 4868 4868 by the original due date of the fiscal year return. Taxpayers who are out of the country. File a Paper Form 4868 If you wish to file on paper instead of electronically complete the Form 4868 below and mail it to the address shown under Where To...

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS Form 4868

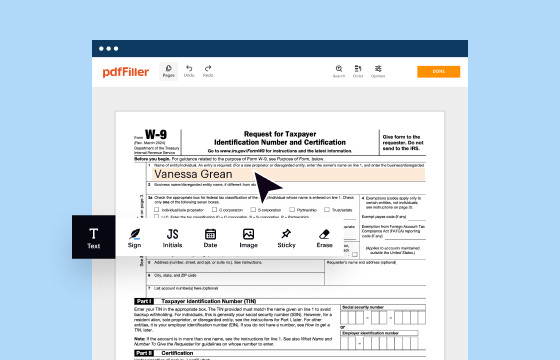

Clear Instructions for Modifying IRS Form 4868

Steps for Completing IRS Form 4868

Understanding and Utilizing IRS Form 4868

IRS Form 4868 is essential for taxpayers seeking an extension to file their income tax returns. This form allows taxpayers an additional six months to submit their returns while ensuring they don't incur penalties for late filing. Understanding how to properly use this form is crucial for maintaining compliance with federal tax obligations.

Clear Instructions for Modifying IRS Form 4868

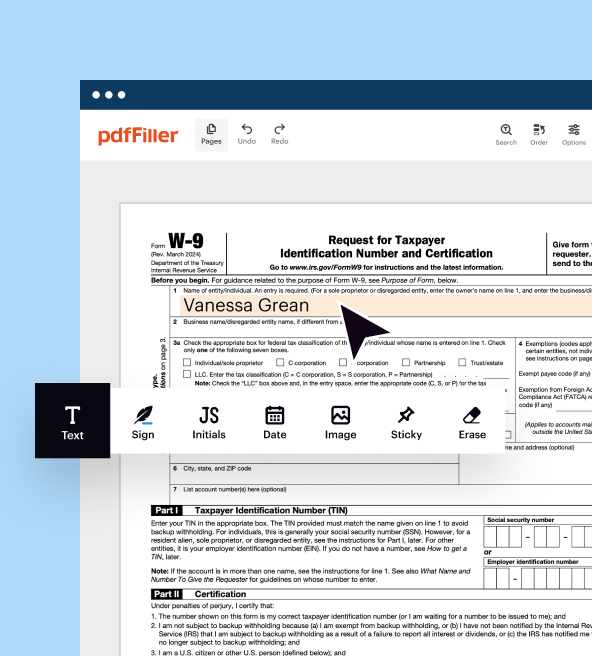

To effectively edit IRS Form 4868, follow these detailed steps:

01

Review previous tax filings or consult tax software to gather necessary information.

02

Download the latest version of Form 4868 from the IRS website to ensure you’re using the most current version.

03

Input taxpayer identification information, including your name, address, and Social Security number (or Employer Identification Number if applicable).

04

Determine your estimated total tax liability and your total payments made, as this information will be necessary for accurate filing.

05

Calculate the balance due, and if applicable, claim any exemptions or special circumstances that may impact your filing due date.

Steps for Completing IRS Form 4868

Completing Form 4868 involves the following steps:

01

Fill in your personal details (name, address, and identification number) at the top of the form.

02

Estimate your total tax liability for the year. This estimate should be as accurate as possible to avoid penalties.

03

Input any tax payments already made and the balance due. If the balance is zero, you may not need to file.

04

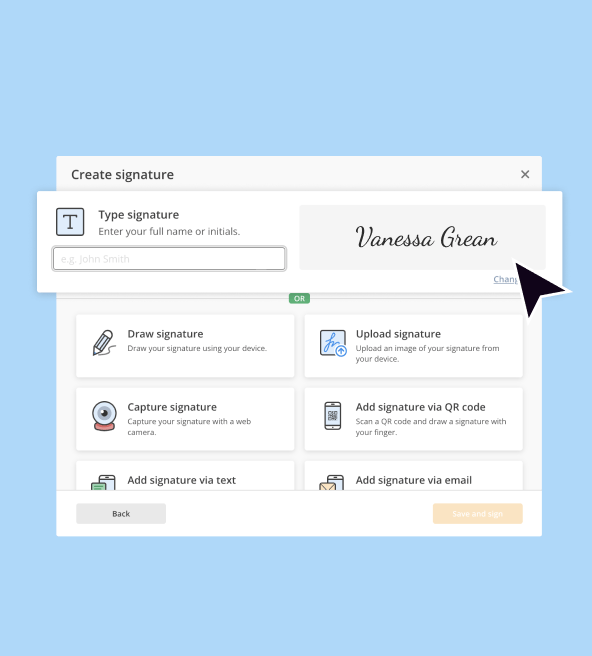

Sign and date the form to certify that the information provided is correct.

05

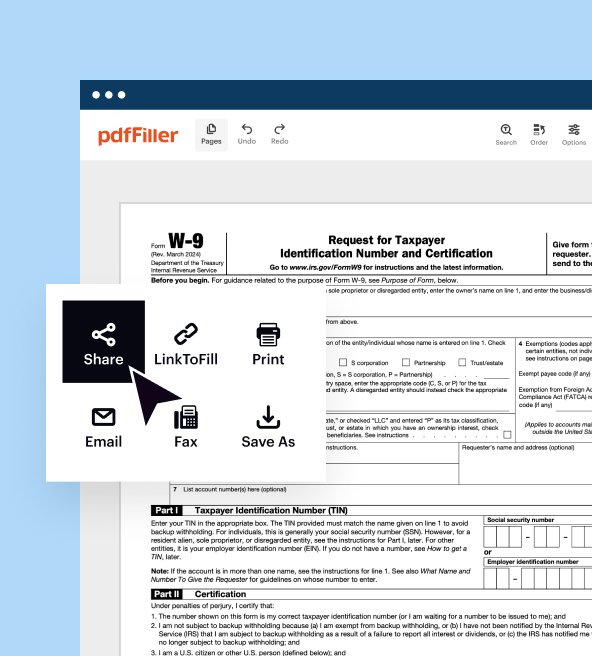

Submit the form electronically or via mail, ensuring it reaches the IRS by the specified deadline.

Show more

Show less

Recent Updates and Changes to IRS Form 4868

Recent Updates and Changes to IRS Form 4868

Staying updated with recent changes to IRS Form 4868 is vital for compliance and effective tax planning. Recently, the IRS has implemented enhancements in the digital submission process, allowing for quicker processing times. Additionally, tax thresholds and estimated payment guidelines may have been updated, reflecting adjustments for inflation or changes in tax law.

Essential Insights into IRS Form 4868

An Overview of IRS Form 4868

The Objective of Form 4868

Who Needs to File Form 4868?

Criteria for Exemptions from Filing Form 4868

Components of IRS Form 4868

Deadline for Submitting Form 4868

Comparing IRS Form 4868 with Other Extension Forms

Transactions Included with Form 4868

Copies Required for Submission of IRS Form 4868

Penalties for Failing to Submit Form 4868

Required Information for Filing Form 4868

Additional Forms That May Accompany IRS Form 4868

Submission Address for IRS Form 4868

Essential Insights into IRS Form 4868

An Overview of IRS Form 4868

IRS Form 4868 is the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. It provides a mechanism for taxpayers to apply for an extension, moving their filing deadline from April 15 to October 15 without incurring late filing penalties, provided they submit the form in time.

The Objective of Form 4868

The primary purpose of Form 4868 is to grant an automatic six-month extension for filing your income tax return. This can be especially useful for taxpayers who require additional time to gather necessary documentation or face unforeseen circumstances impacting their ability to file on time.

Who Needs to File Form 4868?

Generally, anyone who needs more time to file their tax return, including individuals and single-member LLCs, should consider submitting Form 4868. Additionally, those expecting to owe additional taxes or unable to meet tax deadlines due to legitimate circumstances must apply for this extension.

Criteria for Exemptions from Filing Form 4868

Certain conditions allow taxpayers to forego filing Form 4868:

01

Taxpayers expecting a refund and confirming that their taxes have already been fully settled.

02

Individuals whose total income is below the filing threshold, typically based on filing status and age.

03

Those whose transactions are categorized as non-taxable or fall under specific credits, like education credits.

Components of IRS Form 4868

The components of Form 4868 include:

01

Taxpayer Identification Information

02

Estimate of Total Tax Liability

03

Total Payments Made

04

Balance Due

Deadline for Submitting Form 4868

The deadline for filing Form 4868 is typically April 15, aligning with the traditional income tax return deadline. However, if this date falls on a weekend or holiday, the submission can be made on the following business day.

Comparing IRS Form 4868 with Other Extension Forms

IRS Form 4868 is distinct from similar forms, such as Form 7004 for business tax extensions. While Form 4868 applies to individual income tax returns, Form 7004 is intended for corporations and partnerships. Each form has its unique considerations, including different deadlines and types of returns it covers.

Transactions Included with Form 4868

Form 4868 primarily covers individual income tax returns. However, it does not apply to certain specialized tax situations, such as estate taxes or gift taxes, which have separate requirements and forms.

Copies Required for Submission of IRS Form 4868

Typically, only one copy of Form 4868 is required for submission to the IRS. However, taxpayers may wish to retain a copy for personal records or for possible future reference during audits.

Penalties for Failing to Submit Form 4868

Failing to file Form 4868 can lead to serious repercussions:

01

A late filing penalty—typically 5% of the unpaid taxes for each month or part of a month the return is late—up to a maximum of 25%.

02

Failure to pay penalties may accrue interest on any unpaid balance, compounding the taxpayer's total owing amount.

Required Information for Filing Form 4868

To properly file Form 4868, you will need the following information:

01

Your name, mailing address, and taxpayer identification number.

02

The total amount of tax you anticipate owing for the year.

03

Any payments or credits previously submitted.

Additional Forms That May Accompany IRS Form 4868

Additional forms may be needed if you're filing for specific tax situations, such as income discrepancies or other credits that require separate documentation. In those cases, ensure all related forms are included with your submission.

Submission Address for IRS Form 4868

The submission address for IRS Form 4868 varies depending on whether you file electronically or by mail and your state of residence. It's crucial to verify the exact address on the IRS website to ensure timely processing.

In summary, understanding IRS Form 4868 is essential for taxpayers looking to effectively manage their filing deadlines and avoid penalties. By familiarizing yourself with the requirements, exemptions, and processes, you can navigate the tax season more confidently. For further assistance, consider contacting tax professionals or utilizing tax preparation services to ensure compliance.

Show more

Show less

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Easy to use and affordable way to edit your pdf documents. I love that it is cloud based so you can access them anywhere. You can even sign like a docusign.

tried other products and this one worked faster and better without any BS or training needed. it is fast and simple for those computer challenged. easy to use in court or out of court and easy access to all judicial council forms. hats off to pdffilir!

Try Risk Free